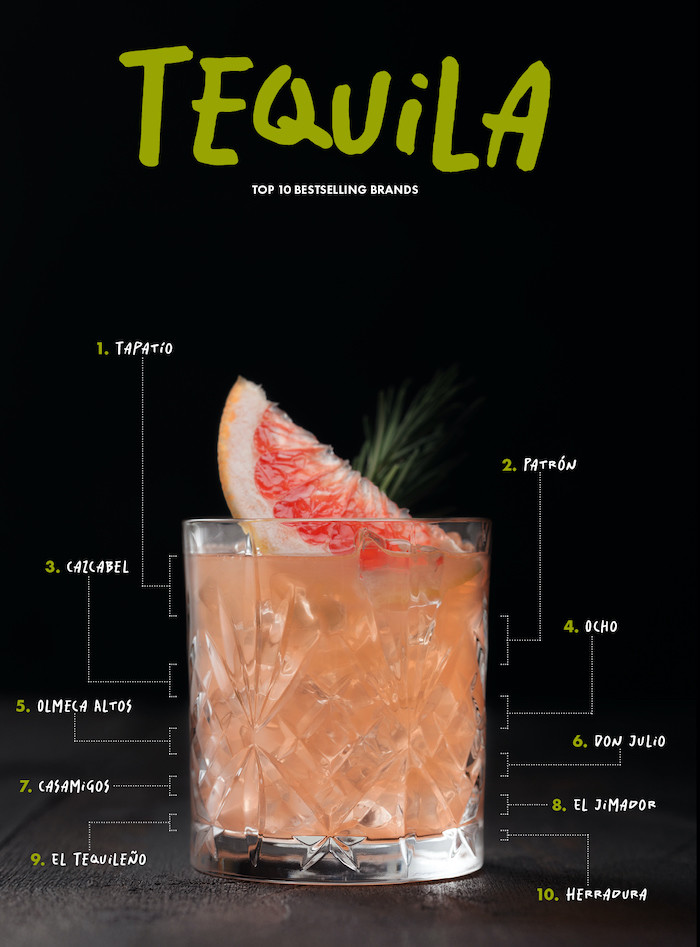

Next up in The CLASS Report we visit the tequila category in the UK's Best Bars.

To understand what makes a bar brand, look no further than Tapatío. Without the marketing budget enjoyed by its bigger adversaries, the Speciality Brands-distributed brand has become the bestselling tequila in the UK’s best bars. Our poll suggests that this small, family-owned brand was the first pick in more than one in five top bars, while 38% said it was among their top-three choices.

Tapatío finds the sweet spot between quality (the Camarena family use traditional brick ovens and a tahona for extraction at its distillery, La Alteña), while the packaging shouts authentic tequila as much as its peppery, agave-laden liquid. The price is one that everyone can get along with too. It’s only a 50cl bottle but we’re talking south of £20 with retros – even in 70cl format, which it will be soon, it’ll come in shy of £30.

Patrón, in second, was found to be the top tequila in about 13% of bars but was actually the most likely second choice and a top three tequila in a third of bars polled. As one of the big three globally and owned by spirits behemoth Bacardi, it is perhaps the brand you might expect to be dominating proceedings, but with a 50% price premium to the likes of Tapatío and Ocho, for many bartenders its upside is the upsell. Bartenders like the brand and so do punters – it remains the brand with the most consumer cut through.

Few tequilas have invested more in the UK trade in the past year or two than Cazcabel, an independent brand owned by the Vazquez family and distributed in the UK by Proof Drinks. Climbing a place to third in our list, it looks to be gaining share – our sample suggests 12% of the UK’s best bars count on it as their go-to tequila, while it’s a top-three choice in more than a fifth.

Cask-distributed Ocho, last year’s runner up, recorded less impressive numbers this year, with the share of the house pour falling from 20% to 7%. Are we seeing a more US-centric strategy start to play out after the Tomas Estes-founded brand’s acquisition by Heaven Hill? We’ll reserve judgement until we see if the trend develops next year. For now, Ocho is still very much a loved brand. Outside of the rail, it’s a second or third-choice tequila in 20% of cases and remains the brand that bartenders get all gooey for. When we asked, it was once again the Bartenders’ Favourite, with Tapatío in second.

Pernod Ricard’s Olmeca Altos is a big brand that seems to be drifting a little – in the UK at least. It’s still fighting over cocktail listings and house pour contracts – 10% of our sample said it was their go-to, but where it’s not the protagonist, Altos rarely makes it on to the back bar, our survey found.

The opposite of which is true for Diageo’s Don Julio, which isn’t really suited to the rail, but was present among the top-three roster at 21% of bars polled. It likely has to share its lunch with stablemate Casamigos, which posted similar numbers.

Diffuser-made brand El Jimador is the cut-price answer to brands’ 100% agave needs and was the choice in 7% of our sample, but almost non-existent on the back bar of our polled venues.

While El Tequileño’s name is growing in the UK, as a mixto its challenge is different – it is to persuade the trade that production integrity is more important than the percentage of agave. Meanwhile, appearing in 10th again, Herradura is more present than omnipresent.