Our first category under the microscope at the UK's Best Bars is gin.

Gin’s evolution from domestic depressive to consumer catnip over the past couple of decades was one of the seminal shifts of British drinking. With this heady success though, things got a bit weird, with brands pushing hard around definition boundaries, making botanicals of anything that sounded vaguely edible.

But as growth has slowed, gin seems to be self correcting. In 2025 the category feels a bit more comfortable in its own skin (so perhaps the Collagin did work), with the landscape starting to resettle around the category’s traditions.

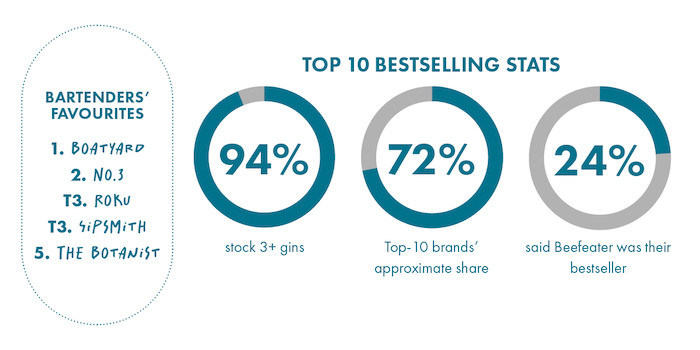

You can see this in our top-10 gin list. Nine of them you would describe as juniper-led, traditional London Dry in style, with only the long-established bar brand Hendrick’s being what you might describe (and they do) as flavour curious.

But heading this list are gins that meet bartenders’ most fundamental criteria – gin that tastes like gin and comes in at a good price. Ahoy Beefeater, Tanqueray and Bombay (Sapphire in most cases) – three brands that offer pull-your-arm-off value for money.

Pernod Ricard’s Beefeater is the gin that’s most likely to be the house pour at the UK’s Best Bars. 24% said it was their go to, but if it wasn’t the contract gin, it barely registered (6% said it was their second or third choice). Meanwhile, Diageo’s Tanqueray was found to have a broader appeal outside of the contract pour – perhaps with more of a cocktail listing strategy. It was the bestseller in 14% of bars but was a second or third choice in a further 23% .

Bacardi’s Bombay was the top seller in 10% of our polled bars and was a second or third choice in a further 10%.

William Grant & Sons’ Hendrick’s stands alone in its offering because it doesn’t really have direct competitors – a rose and cucumber taste profile has a habit of setting a brand apart. That, distinctive marketing and a parent company that believes in investing in the UK trade, have together created an evergreen bar brand. It may not be the big volume player of the category (it was the bestseller in 6% of our sample), but it’s a must for the back bar – 21% said it was among their second and third choices.

From here, our data suggests that market share is more fractional. Brown-Forman’s Fords in fifth is a brand built around bartenders’ needs – from bottle, to juniper-forward juice to price. Founder Simon Ford remains the driving force and the brand seems to be finding traction around the country after a steady stream of investment and activations over the past couple of years. It’s a top-three serve in 14% of our panel.

Berry Bros & Rudd’s No.3 Gin has gained a following in the UK for its dry, robust, juniper-led style and, much like Boatyard, is often Martini glass bound. For Boatyard, the focus has seen laser precision, to the point its figurehead, Declan McGurk, even has his own cocktail – Dec’s Martini at Amaro. Both brands have about a 5% volume share in the UK’s best bars.

It goes to underline that, in a category where three brands dominate volume, others must create meaningful relationships with the trade to succeed. Jake Burger’s Portobello Road gin (in 9th) is another great example of this, while Sipsmith (10th this year) is another to have a longstanding bond with bartenders, though likely shares volumes with Suntory stablemate Roku which is in 8th.